Introduction

After several years of economic stagnation, Japan’s stock market – often referred to as Nippon stocks – is finally making global headlines. In fact, Japan’s main stock index, the Nikkei 225, recently surpassed its all-time high set in 1989. For U.S. investors, this sudden momentum in the Japanese market presents both opportunity and risk. So, what’s driving this trend? And should U.S. investors put their money into it?

Let’s break it down.

What’s Driving the Nippon Stock Rally?

Japan’s stock market is booming in 2025, and here’s why:

1. Corporate Reforms in Japan

Japanese companies are undergoing major reforms to boost profitability and shareholder value. With pressure from the Tokyo Stock Exchange and global investors, many firms are:

- Increasing dividend payouts

- Engaging in stock buybacks

- Improving transparency and governance

These are the same practices that U.S. investors love to see in their own markets.

2. Weak Yen = Stronger Exports

The Japanese yen has remained weak compared to the U.S. dollar, making Japanese goods cheaper and more competitive globally. This has been great for export-driven companies like:

- Toyota

- Sony

- Hitachi

- Mitsubishi

As a result, these companies are reporting strong earnings, driving up stock prices.

3. Foreign Capital Inflows

Foreign institutional investors, including those from the U.S., are pumping money into Japan’s stock market. With valuations still relatively low compared to U.S. stocks, Japan is seen as a bargain buy with upside potential.

4. AI & Tech Growth in Asia

Japan is a leader in semiconductors, robotics, and AI hardware—areas seeing global growth. Companies like Tokyo Electron and Renesas Electronics are at the forefront of this tech boom.

Why Should U.S. Investors Care?

You might be thinking, “That’s great for Japan—but what does it mean for me?” Here’s why Nippon stocks matter to U.S. investors:

✅ Diversification

Investing in Japanese stocks provides geographic and economic diversification, reducing reliance on the U.S. market.

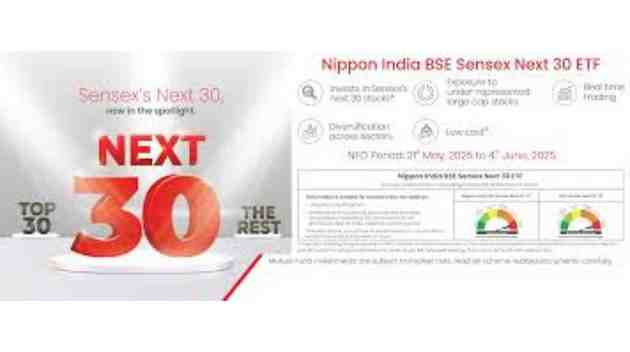

✅ ETF Access

You don’t have to buy individual Japanese stocks. U.S.-listed ETFs like:

- iShares MSCI Japan ETF (EWJ)

- WisdomTree Japan Hedged Equity Fund (DXJ)

make it easy to get exposure with a few clicks.

✅ Valuation Gap

While U.S. markets remain at high valuations, Japanese stocks are comparatively undervalued—which may offer better entry points for long-term investors.

Risks to Watch

Of course, investing in any foreign market comes with challenges:

- Currency risk – If the yen gains strength against the dollar, your returns could shrink.

- Geopolitical concerns – Rising tensions in East Asia (e.g., China-Taiwan relations) may indirectly affect Japan’s market.

Slower domestic growth – Japan still faces long-term challenges like a shrinking population and low inflation.

How to Start Investing in Nippon Stocks

If you’re interested in riding the wave, here are some simple steps:

- Use ETFs – Start with U.S.-listed Japan-focused ETFs.

- Look for ADRs – Some Japanese companies trade as ADRs (American Depositary Receipts) on U.S. exchanges, such as:

Toyota (TM)

Sony (SONY) - Check International Funds – Many global mutual funds and index funds include Japanese exposure.

Final Thoughts

Japan’s stock market is undergoing historic change, and global investors – particularly in the US – are starting to take notice. While Nippon stock’s boom may seem far removed from Wall Street, it could provide the kind of diversified, long-term growth that every savvy investor should consider. And it’s a steelmaker that imports steel-related products, so the company has been in the spotlight.

As always, do your research, speak with a financial advisor, and invest according to your risk tolerance.

Quick Recap: Why Nippon Stocks Matter in 2025

- ✅ Corporate reform is boosting shareholder value

- ✅ Exporters are thriving thanks to a weak yen

- ✅ Tech and semiconductor leaders are booming

- ✅ U.S. ETFs and ADRs make investing easy