Introduction: Why HIMS Is Catching Wall Street’s Eye

Hims & Hers Health, Inc. (NASDAQ: HIMS) is turning heads in 2025—and for good reason. As one of the most recognizable names in digital healthcare, Hims is capitalizing on the growing demand for accessible, personalized, and stigma-free medical care. From mental health to skincare to sexual wellness, the company offers a modern telehealth platform that speaks directly to millennials and Gen Z.

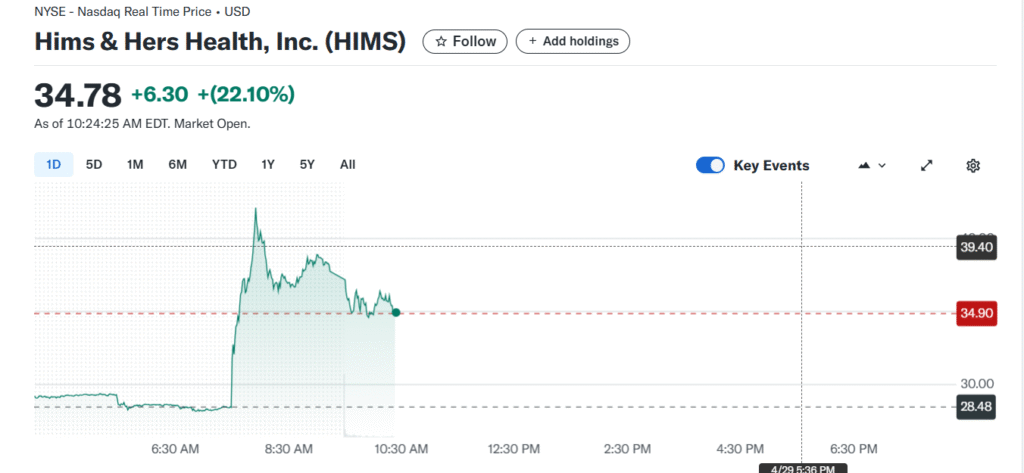

Now, the stock is on fire—up more than 45% year-to-date—and it’s becoming a favorite among retail investors, growth-focused funds, and even some big-name analysts.

Quick Company Snapshot

- Ticker: HIMS

- Exchange: NASDAQ

- Founded: 2017

- Industry: Digital Healthcare / Telemedicine

Headquarters: San Francisco, California

Hims & Hers Health provides direct-to-consumer healthcare through its website and mobile app, helping users connect with licensed providers and receive treatment from the comfort of home.

What’s Fueling the HIMS Stock Surge?

Here are the key reasons why HIMS is trending right now:

1. Strong Q1 2025 Earnings

The company exceeded analyst expectations with impressive revenue growth and rising monthly subscribers.

2. Profitability Is Within Reach

Hims is inching closer to GAAP profitability—something rare in this space—by controlling costs while expanding its reach.

3. AI-Driven Health Services

The recent integration of AI tools for faster diagnostics and improved patient interaction has set Hims & Hers Health apart from traditional telehealth players.

4. Powerful Branding & User Trust

With viral marketing campaigns and celebrity endorsements, Hims is becoming a lifestyle brand, not just a medical service.

2025 Performance Snapshot

HIMS stock has been a standout in the healthcare sector this year.

- Year-to-Date Return: +45% (as of April 2025)

- 52-Week Price Range: $6.30 – $18.45

- Market Cap: Approximately $3 billion

This surge in stock price reflects a mix of solid business fundamentals, growing user loyalty, and broader optimism about the future of telemedicine.

What Are the Risks?

No stock is without risk—and HIMS is no exception. Investors should be mindful of:

- Fierce competition from players like Teladoc, Ro, and emerging health startups.

- Regulatory uncertainty, as healthcare policies and telehealth laws continue to evolve.

- Marketing-heavy spending, which could impact margins if user growth slows down.

Analyst Sentiment: Mostly Bullish

Many Wall Street analysts are warming up to HIMS, upgrading the stock to “Buy” or “Overweight.”

- Average Price Target: Between $20 and $22

- Key Drivers: Recurring subscription revenue, low churn rates, and a scalable digital model.

Final Thoughts: Is HIMS Worth Buying?

Hims and Hars Health is no longer a trendy startup – it has quickly become a real player in the future of healthcare. With its direct-to-consumer focus, user-friendly technology and treatment categories, HIMS is well deployed for long-term development.

If you are a retail investor who is in contact with the telehottage trend, Hims & Hers Health can be a smart stock for your wochelist – and this can bring your portfolio for quite a lot. Be sure to balance enthusiasm with simply proper risk evaluation.

2 thoughts on “Hims & Hers Health (HIMS) Stock: A Rising Star in the Telehealth Revolution🚀”