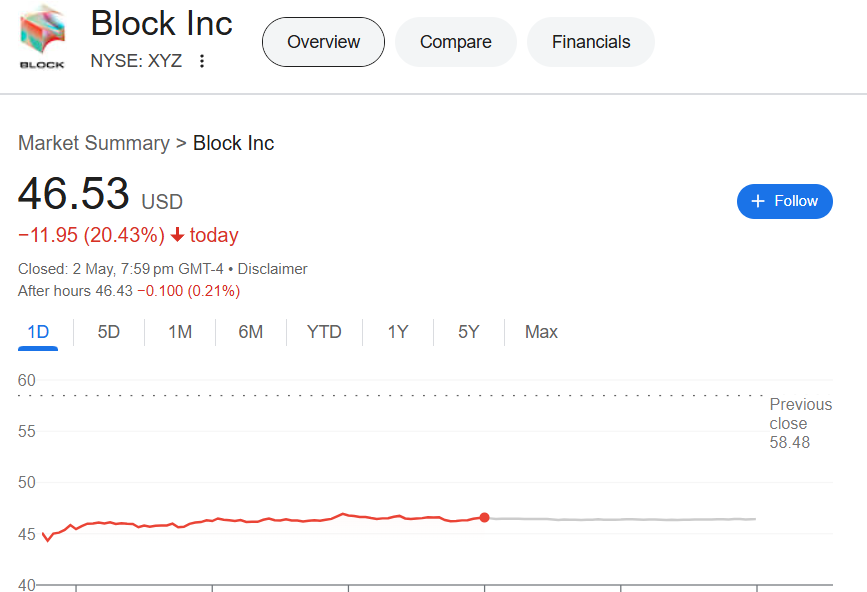

Block stock (NYSE: SQ) dropped nearly 20% in a single day, leaving investors shocked and uncertain. The sudden fall made headlines and sparked questions about what went wrong — and what happens next.

📉 Why Did Block Stock Drop So Much?

1. Weak Earnings Repor

Block Stock Inc. released its latest earnings report, and the numbers didn’t meet expectations. While revenue increased, rising costs hurt profits. That worried Wall Street — and hit the Block stock price hard.

2. Slower Growth in Cash App

Cash App is Block Stock most popular product. But this time, its user growth and payment activity slowed down. Investors are now asking if Block’s best product is starting to lose steam.

3.Bitcoin and Crypto Volatility

Block Stock owns Bitcoin and offers crypto services through Cash App. So, when crypto prices fall, Block stock often takes a hit too. The recent drop in Bitcoin added pressure to the stock.

😟 How Are Investors Reacting?

The 20% drop in Block stock has split investors into two camps. Some are selling in fear, while others see this as a chance to “buy the dip” and invest for the long term.

📊 What’s the Future of Block Stock?

Analysts say Block Stock still has growth potential, especially if it controls costs and improves profitability. But if future earnings disappoint again, Block stock could face more downside.

✅ Final Thoughts

A 20% single-day drop is serious, but not always the end of the story. If you already hold Block stock, stay calm and review your investment strategy. If you’re considering buying, make sure to research carefully — and think long term.

Key Takeaway

Block stock is under pressure, but the company still has room to bounce back. Whether you’re buying, holding, or selling — stay informed and invest wisely.