Introduction

Teladoc Health Inc. (NYSE: TDOC) was once one of the hottest pandemic-era stocks. But in 2025, many investors are wondering: Is TDOC still worth holding — or is it time to move on?

In this article, we’ll break down the current state of TDOC stock, what’s driving its trend today, and what analysts are forecasting.

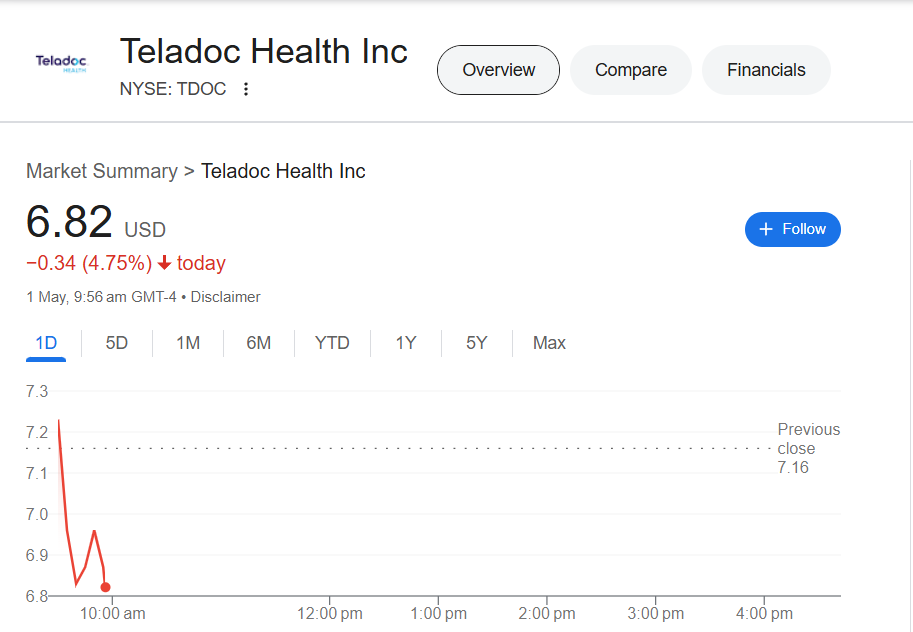

TDOC Stock at a Glance 📈

| Key Metric | Value |

| Current Price | $7.19 |

| Market Cap | $1.26 billion |

| 52-Week Range | $6.35 – $15.21 |

What Does Teladoc Health Do? 🏥

Teladoc Health is a global leader in telemedicine and virtual care services. The company connects patients with doctors, therapists, and medical experts remotely, using a digital platform.

During the COVID-19 pandemic, TDOC’s user base and revenue surged — but in recent years, growth has slowed. Now, investors are watching closely to see if the company can innovate and scale profitably.

Why Is TDOC Stock Trending Now? 🔥

TDOC stock is back in the spotlight because of:

- ✅ Better-than-expected Q1 earnings

- ✅ Cost-cutting strategies to improve margins

- ⚠️ Mixed analyst reactions to future revenue guidance

Recent reports from Yahoo Finance, MarketWatch, and Bloomberg show a divided sentiment among institutional investors.

Stock Performance & Financial Overview📊

- Q1 2025 Earnings: Teladoc Health reported a net loss per share between $0.40 and $0.15 for Q1 2025, with revenue guidance ranging from $608 million to $629 million. MarketBeat+2MarketScreener+2Ticker Report+2

- User Growth: The company reported 93.8 million U.S. Integrated Care members, an increase of 4.2 million year over year. Valley City Times-Record

- Profitability: Teladoc continues to face challenges in achieving consistent profitability. The company reported a net loss of $48.4 million, or $0.28 per share, for Q4 2024. Teladoc Health

- Debt: As of June 2024, Teladoc Health’s total debt stood at approximately ₹133.29 billion. CompaniesMarketCap

📢 Pro Tip: Always check trusted sources like Seeking Alpha, TipRanks, and Yahoo Finance for updated analyst outlooks.

Pros and Cons of Investing in TDOC✅

Pros:

- 🌐 Leader in virtual healthcare

- 📱 Tech-first approach to patient care

- 🧠 Expanding into mental health, chronic care, and AI-based services

Cons:

- 📉 Declining growth post-pandemic

- 💸 Profitability challenges

🏥 Increasing competition from Amazon, CVS, and others

Final Verdict: Should You Buy TDOC in 2025? 🧠

TDOC is no longer a “growth rocket,” but it may now be a long-term value play in a growing digital healthcare market. If you believe telemedicine will keep evolving — and Teladoc can tighten its operations — TDOC might be a smart hold or buy on dips.

However, if you’re looking for short-term gains or dividend income, this stock may not fit your strategy in 2025.

Here are the best sites to track TDOC stock daily:

⚠️ Disclaimer: This article is for informational purposes only and not investment advice. Please consult a licensed financial advisor before making decisions.

1 thought on “ TDOC Stock: Is Teladoc Health Still a Smart Investment in 2025?💹”