Dollar General (NYSE: DG) has long been a favorite among value shoppers and conservative investors. Known for its wide reach in rural America and reputation as a budget-friendly retailer, Dollar General was once considered a “recession-proof” stock. But in 2024 and now 2025, the company faces turmoil. So what’s happening with Dollar General stock? Is it still worth investing in, or should investors be cautious? Let’s break this down in a simple, practical, and pragmatic way.

Dollar General: A Quick Overview

Founded in 1939, Dollar General operates more than 19,000 stores across the U.S., primarily in underserved rural areas. The company offers low prices on products ranging from everyday groceries to household necessities.

Dollar General stock has historically thrived during tough economic times – when budgets are tight, people turn to the cheaper store. This is why it has earned a reputation as a “defensive” stock.

Why Is Dollar General Stock Struggling?

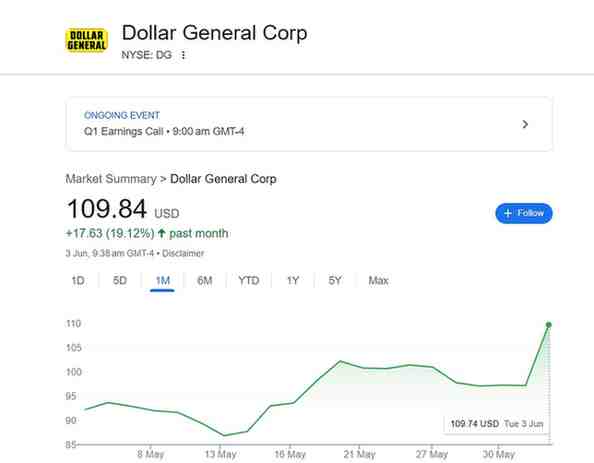

In 2023 and 2024, DG stock saw a sharp decline—dropping more than 40% from its previous highs. Let’s explore the key reasons behind the slide:

1. Consumer Fatigue and Inflation Pressure

While inflation has eased compared to 2022, many Americans are still struggling with high prices for food, gas, and rent. This has led even Dollar General’s core customers to cut back on spending.

2. Operational Challenges

Dollar General has been hit by:

- Staffing shortages

- Poor in-store conditions

- Inventory management issues

These factors have negatively affected customer experience and sales.

3. Leadership Transition

In October 2023, Todd Vasos returned as CEO after the ouster of Jeff Owen. Investors hoped Vasos could turn things around, but recovery has been slow.

📈 Recent Performance and Earnings

Dollar General reported Q1 2025 earnings recently, and here’s the summary:

- Revenue: Slightly below expectations

- EPS (Earnings Per Share): Missed Wall Street estimates

- Same-store sales: Declined year-over-year

- Outlook: Management issued cautious guidance for the rest of 2025

Investors were disappointed, and the stock took another dip after the report.

What’s the Future for Dollar General?

Despite the recent setbacks, analysts are not completely bearish on DG. Some believe there is room for a turnaround.

Here’s what could drive a comeback:

- Improved operational efficiency under Vasos

- Store remodeling and better supply chain management

- Focus on private-label products to increase margins

- Tailwind from any economic slowdown, which may push shoppers back to discount stores

However, the road ahead won’t be easy. Dollar General needs to rebuild trust with both shoppers and investors.

Should You Invest in Dollar General Stock Now?

Pros:

✅ Strong brand in rural America

✅ Recession-resistant business model

✅ Potential upside if the turnaround works

Cons:

❌ Operational concerns

❌ Weak earnings performance

❌ Market competition from Walmart, Family Dollar, and others

If you’re a long-term investor who believes in DG’s recovery plan and leadership, this may be a chance to buy the stock at a discount. But for short-term traders, volatility and uncertainty could make it a risky bet.

Final Thoughts

Dollar General stock isn’t completely doomed — but it’s at a crossroads. The stock’s poor performance has set off alarm bells, but has also created opportunities. With a strong legacy and broad customer base, a successful turnaround could reward patient investors.

As always, make sure to do your own research (DYOR) and consider your financial goals and risk tolerance before investing.

📌 Frequently Asked Questions (FAQ)

❓Is Dollar General a good stock to buy in 2025?

Dollar General could be a good long-term investment if its turnaround strategy works. However, short-term risks remain due to recent weak earnings and operational issues.

❓Why is Dollar General stock falling?

The stock has been falling due to slowing sales, inflation impacting customers, operational problems like store conditions, and missed earnings expectations.

❓Who is the current CEO of Dollar General?

As of 2025, Todd Vasos is the CEO of Dollar General, returning to the role in late 2023 to help stabilize the company.

❓How many stores does Dollar General have?

Dollar General operates over 19,000 stores across the United States, primarily in rural and low-income areas.

❓How many stores does Dollar General have?

Dollar General operates over 19,000 stores across the United States, primarily in rural and low-income areas.

❓What is the stock symbol for Dollar General?

Dollar General trades under the ticker symbol DG on the New York Stock Exchange (NYSE).

❓Does Dollar General pay dividends?

Yes, Dollar General pays a quarterly dividend, although the yield is relatively modest. Investors should check the latest dividend declarations for accurate rates.