Walmart Inc. (NYSE: WMT) has long been considered a staple in the portfolios of both retail and institutional investors. Known for its vast retail empire and steady dividends, WMT stock is making headlines again in 2025. But what’s all the buzz? And most importantly – should you buy, hold, or sell it?

Let’s take a look at the latest trends, performance, and future outlook for Walmart stock.

🏬 Walmart in 2025: More Than Just a Retail Giant

Walmart has transformed itself from a traditional brick-and-mortar retailer into a hybrid powerhouse that combines physical stores with e-commerce. With more than 4,600 U.S. stores and a strong online presence, Walmart targets low-income and price-conscious middle-class consumers. It also provides employment to many people.

In recent years, the company has made key moves into:

- E-commerce and grocery delivery

- Healthcare services (Walmart Health)

- Financial services through Walmart-backed fintech initiatives

- AI and automation for supply chain optimization

These expansions have helped Walmart stay competitive with Amazon and Target.

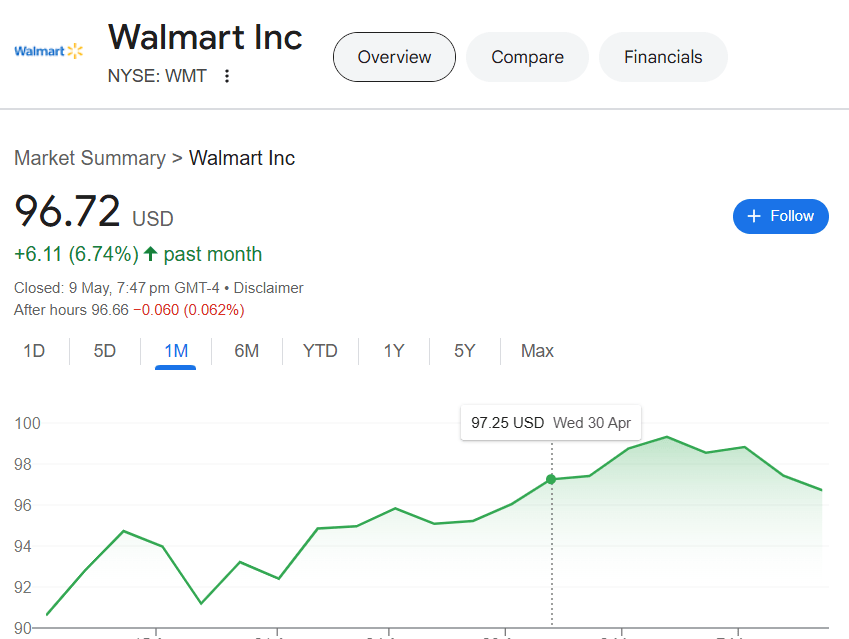

📊 WMT Stock Performance: A Snapshot

As of May 2025, WMT stock is trading around $62–$64 per share (adjust for stock split if necessary). Here’s a quick look at recent stats:

- 52-week range: $49 – $65

- Market Cap: Over $430 billion

- Dividend Yield: ~1.5%

- P/E Ratio: 28–32 (slightly above the retail sector average)

Despite market volatility in 2024, Walmart’s stock has remained relatively stable and defensive, making it a favorite in times of economic uncertainty.

🔍 What’s Driving the Current Surge in WMT Stock?

1. Strong Q1 2025 Earnings Beat

- Walmart recently reported better-than-expected earnings, driven by strong grocery sales and online order volume.

- Comparable-store sales rose by 5.3%, beating Wall Street estimates.

2. AI-Powered Retail Operations

- Walmart’s investment in AI for inventory management and customer experience is starting to pay off.

- Analysts see this as a long-term growth engine that could improve margins.

3. Expansion of Walmart Health Clinics

- Healthcare services continue to grow, especially in underserved rural areas.

- It opens a new revenue stream beyond retail.

4. Resilient Consumer Base

- Amid inflation concerns, more Americans are shopping at Walmart for affordability.

- This gives Walmart a defensive edge compared to premium retailers.

Analyst Ratings: Bullish or Bearish?

The consensus on Wall Street is largely bullish:

- JP Morgan: Overweight, target price $70

- Bank of America: Buy, target $68

- Goldman Sachs: Neutral, but upgraded outlook from 2024

- Morningstar: Fair value estimate of $67

Analysts highlight Walmart’s ability to manage costs, leverage data, and expand strategically.

Dividend and Long-Term Value

Walmart has been a dividend aristocrat—increasing its dividend for over 50 years. While the current dividend yield is modest, the stability and consistency appeal to long-term investors seeking income and capital preservation.

Should You Buy WMT Stock in 2025?

✅ Buy If:

- You want a safe, defensive stock in your portfolio

- You believe in the future of AI-driven retail and healthcare

- You prefer stable dividends and lower volatility

❌ Consider Holding or Avoiding If:

- You’re looking for high-growth, tech-like returns

- You believe inflation or economic downturn will deeply impact consumer spending

Final Thoughts: WMT Stock Remains a Solid Bet

In a market full of hype and risk, Walmart continues to perform well. It may not be flashy, but it is reliable. For investors who value stability, steady growth and dividend income, WMT stock remains a smart long-term play in 2025. It has become a huge company today.